According to recently published research, household bill have risen by an astonishing 25% in the past five years. More specifically, the cost of gas used in cooking and heating has risen on average by 52% and the cost of car insurance has risen 67% in those five years.

The problem of rising household costs has been compounded by salaries not rising in line with the cost of living, largely due to the economic downturn. The research by USwitch also found that people are more worried than ever about how to manage their finances. Indeed, the study revealed that over 50% of respondents named rising living costs as their biggest fear.

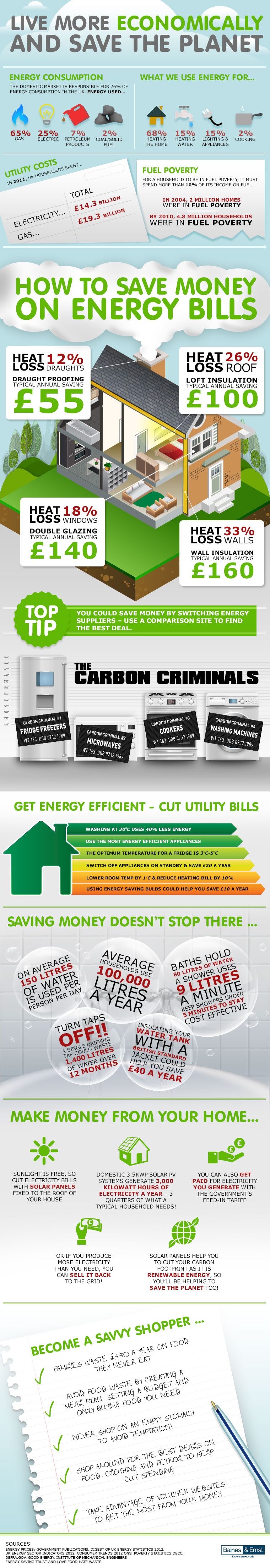

The new Infographic from financial solutions experts, Baines and Ernst, called ‘Live more economically and save the planet’, examines five main ways in which you can ease these worries by reducing your household bills every month.

1) Making your home more energy-efficient

There are measures you can take to make your home more energy efficient. Fitting loft insulation can typically save £100 per year in energy costs and draught-proofing around the home can save £55. Although there is an initial cost to implementing these measures, the money will be recouped within just a few years. There are also government and energy-company schemes which can help some households with the costs.

2) How to Save Money on Energy Bills

Simple measures such as turning unnecessary lights off around the house, not leaving appliances on standby and using your washing machine at a lower temperature setting will all result in a savings in household bills. Indeed, a survey by the Energy Saving Trust revealed that leaving appliances on standby can cost the average household at least an additional £50 per year.

3) Saving Money on Household Bills

A great quick way to save money on household bills is to use a price-comparison service such as Solve and Save, which is offered by Baines and Ernst. After a quick phone call to check details, they will check with a panel of suppliers to see if you have the cheapest utility tariff. If a better rate is found, help can be provided to make the switch over to the new supplier. This service can also be provided for home and life insurance policies.

4) Making Money from Your Home

In addition to saving money on energy and household bills, there are ways to actually make money from your home.

One example of this is to install solar panels on the roof of your house. The government has a scheme which means that you can get paid for the electricity generated (even if you use that electricity yourself) with its feed-in tariff scheme. In addition, any surplus energy generated can be sold back to the National Grid. This is also a very environmentally friendly way of making some extra cash!

5) Becoming a Savvy Shopper

There are several easy ways to becoming a savvy shopper. The first is to always check what offers are available on products that you buy regularly, such as basic food items and petrol.

The Internet is also a great tool for shopping round to find the best possible deals on potential purchases. Often you can also find money-off vouchers available to print off and a quick search for these before you go shopping can save you money.

It has been estimated that the average household wastes almost £500 per year on food which is thrown away. Simple measures such as making a weekly food menu plan and using this to prepare a shopping list before going to the supermarket will undoubtedly cut down on your grocery shopping bill and eliminate much food waste.

Speak Your Mind